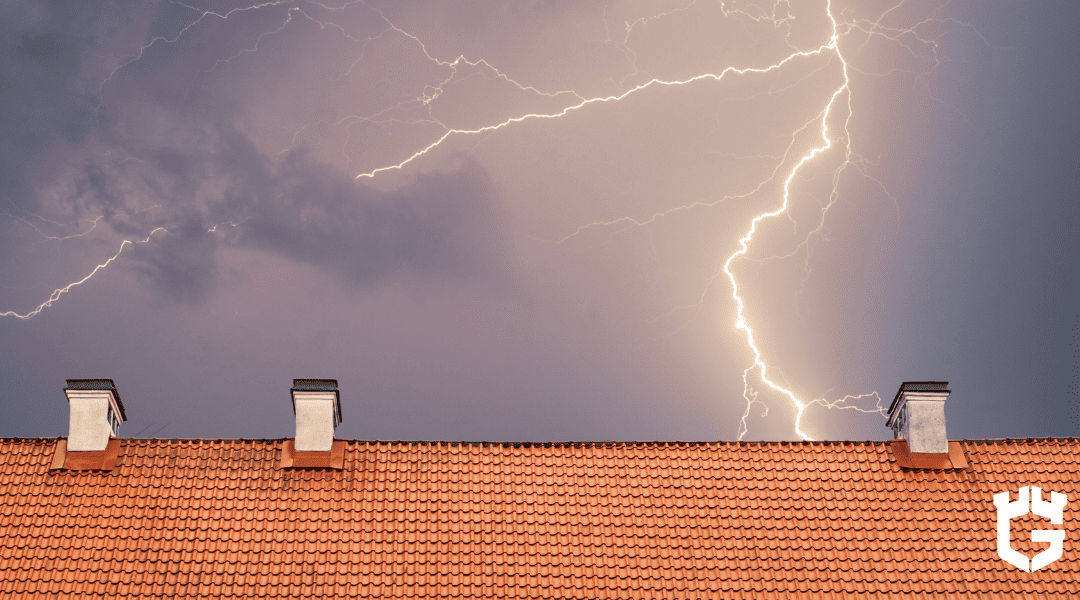

In Maryland, we’ve recently witnessed a series of massive storms. Lightning has wreaked havoc across the state, leaving families worried and unsure about their home’s safety and their financial future. Lightning strikes are a widespread issue that many are grappling with, and lightning-related insurance claims are more common than you might think.

According to the Insurance Information Institute, lightning-caused claims increased by 2.2 percent in 2022, reaching 62,189 cases nationwide. Our close neighbor, Pennsylvania, ranks among the top 10 states with the greatest number of insurance claims due to lightning.

So, what happens when lightning strikes your property? Does insurance cover lightning strikes?

Does Homeowners Insurance Cover Lightning Strikes?

Standard homeowners insurance policies do cover lightning-strike damage. This coverage extends to your home and other structures on your property. Here’s what you can expect:

● Fires ignited by lightning are covered.

● Personal possessions damaged by lightning are also typically covered, up to 50-70% of the dwelling coverage limit.

● Additional living expenses if the home is uninhabitable are covered, usually around 20% of the dwelling limit.

Lightning Strike Insurance Claims for Homes

To file a lightning strike insurance claim, contact your insurance company as soon as possible after the event. An adjuster will inspect and assess the lightning strike damage.

If the repair costs exceed your deductible, the insurance company will pay installments to initiate repairs and complete them.

Special Cases in Homeowners Insurance

It can be more challenging to prove ground surge damage caused by lightning striking near the home, which may result in fewer claims being paid out.

However with some companies, you can add equipment breakdown coverage for extra protection. Additionally, damage to trees on your property caused by lightning would be covered, including the cost of removing and repairing any damaged structures like a fence or roof. This payout might be limited to $1500 or under depending on the company.

Does Car Insurance Cover Lightning Strikes?

Yes, comprehensive auto coverage pays for lightning damage to vehicles, minus your deductible. It covers the cost of repairs or a total loss payout if your car is totaled. Without comprehensive coverage, you’ll have to pay for the repairs out of pocket.

Lightning Strike Insurance Claims for Cars Lightning can damage a car’s electrical system and safety components without causing visible exterior damage. After a suspected lightning strike, it’s essential to have a mechanic inspect the vehicle as soon as possible.

File a claim immediately and provide evidence like weather reports to prove lightning strike damage. Once the insurance company assesses and approves valid claims, your car may require re-inspection to ensure that safety components were properly fixed before disbursing the final claim amount.

Safety is Always the Best Policy

An insurance payout can cover lightning strike damage, but no money can replace the peace of mind that comes with knowing you’ve done everything you can to protect your home and loved ones.

Tips for Home Safety:

● Install Surge Protectors: Protect your home’s electrical grid from voltage spikes.

● Lightning Protection System: Consider installing a comprehensive system to safely divert lightning into the ground.

● Working Smoke Detectors: Ensure that smoke detectors are functional so you’re alerted immediately if a fire breaks out.

Tips for Vehicle Safety:

● Stay Inside the Vehicle: If you’re driving or outdoors away from home, stay inside your car. The car’s outer metal shell provides some protection, but only if you’re inside with the windows closed.

● Avoid Leaning on the Car: Contrary to popular belief, rubber tires do not offer protection if you’re outside leaning on it.

Keep an eye on weather forecasts, and remember, if you hear thunder, you’re close enough to be struck by lightning. Head indoors or into your car immediately.

Does homeowners insurance cover lightning strikes? Does car insurance cover lightning strikes? These are important questions, but they are secondary to the primary goal: your safety and that of your family.

Remember, the best defense is a good offense. Stay safe, stay protected.

Gerety Insurance – Partner in Your Protection

For more information on protecting yourself against the financial losses caused by lightning strikes, don’t hesitate to contact us at Gerety Insurance. We’ve been serving the community for over 25 years and are here to ensure you have the right coverage at the right price.

We pride ourselves on being more than just an insurance provider; we’re a trusted partner committed to ensuring you have the right coverage at the right price. Our team offers personalized consultations, walking you through your options so you can make an informed decision that best suits your needs.

Request a quote today and find a reliable partner for your protection.