What are Bonds?

At Gerety Insurance, we offer multiple type of bonds for personal and commercial clients. Commercial Bonds are powerful tool designed to mitigate the risks associated with commercial investments. Whether you’re a seasoned entrepreneur or a growing business, our Bonds act as a protective shield for your financial commitments. For personal clients we offer a variety of Probate and Estate Bonds for those administrating or who are an executor of an estate.

Why do you need a Bond to Administer an Estate?

Why would you business need a Bond?

Some examples on why your business would need a bond would include:

– You have a 401k plan in place for your employees

– You hold a contracting license with the state

– You are entering into a construction contract requiring you to bond your work

– The bond is required by the government before entering the contract.

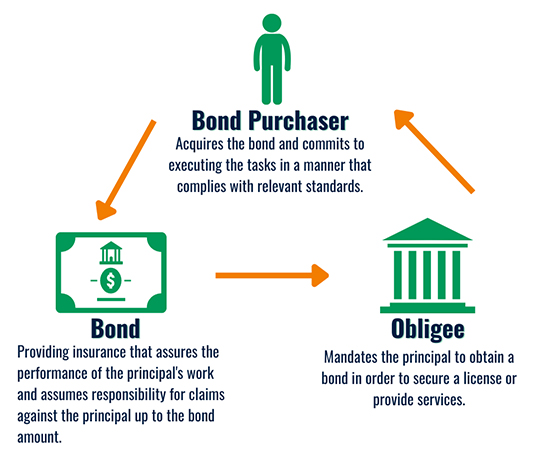

What is the Process of Obtaining a Bond?

What types of Bond Insurance are available?

• Contractor/ConstructionBonds

• Probate or EstateBonds

• ERISA Bonds (401k Bonds)

• Fidelity Bonds

• Fiduciary Bonds

• Performance Bonds

• Permit and License(Needed for your State Licensing Requirements)

• Probate Bonds

• Sub-Division Bonds

• Surety Bonds

• Water and Sewer Bonds

Benefits of choosing Gerety Insurance?

Ready to secure your business investments?

Benefits of Choosing Gerety Insurance

25 Years

of experience in the industry. We bring unparalleled expertise to the table.

Dedicated Team

that is here to protect you. You can rest easy.

Prioritized Protection

whether you have questions about your policy or need assistance during a claim.

Ready to secure your business investments?

Contact Gerety Insurance today for a personalized consultation. Don’t leave your financial future unprotected – choose Commercial Bond for a resilient and thriving business.